Investment Manager

Inpulse is a Brussels-based investment manager with special know-how on social investments and microfinance. From a core expertise in cooperative equity financing, we developed strong skills in managing alternative investment funds providing responsible long-term financing to socially driven financial intermediaries. Strong connections with leading microfinance and social economy networks and multiple partnerships with successful stakeholders ensure a sound understanding of the market we invest in. Through our team based in three countries (Belgium, Poland and France), we currently support 3 active MIVs with a total aggregate investment capacity of EUR 61M.

Inpulse strives to bring positive changes in the life of final beneficiaries while ensuring competitive financial and social returns for both our clients and investors. This is Inpulse ADN.

Our Ambition

Inpulse wants to be a leader in providing long-term responsible finance to empower vulnerable groups. Impulse aims to foster cooperative values, boost local economies and encourage social inclusion through entrepreneurship.

Our Mission

Inpulse commits to:

- tailor and engineer fair financial and non-financial services to serve inclusive financial institutions;

- manage and support investment vehicles sharing the same ambition;

- leverage resources addressed to responsible economic initiatives;

- operate as an impact driven organisation joining professional investors and ultimate beneficiaries.

Our Values

In order to reach out to our ambition, Inpulse team is committed with the company on shared values and ethics.

Integrity

Our actions are driven by honesty, fairness and high moral principles.

Transparency

Our decisions are guided by principles of transparency and good faith.

Respect and fairness of treatment

We treats all individuals with respect and dignity regardless of their differences.

Exemplarity

We act of a such high quality to serve as an example to each other, to our clients and investors.

- Inpulse is a cooperative company registered under Belgian Law.

- Inpulse majority shareholder is Groupe Crédit Coopératif which owns 65%.

- In June 2021, SIDI acquired 35% of Inpulse share capital (more information).

The Board of Directors is composed of:

- Pierre VALENTIN, Chairman of the Board

- Jérôme SADDIER, Board member

- Jean-Paul COURTOIS, Board member

- Dominique de CRAYENCOUR, Board Member

- Dany MAKLOUF, Board Member

- Birgitta VAN ITTERBEEK, Board Member

- Benoît CATEL as representative of CREDIT COOPERATIF, Board Member

- Dominique LESAFFRE, Board Member

- Anne-Sophie BOUGOUIN, Board Member

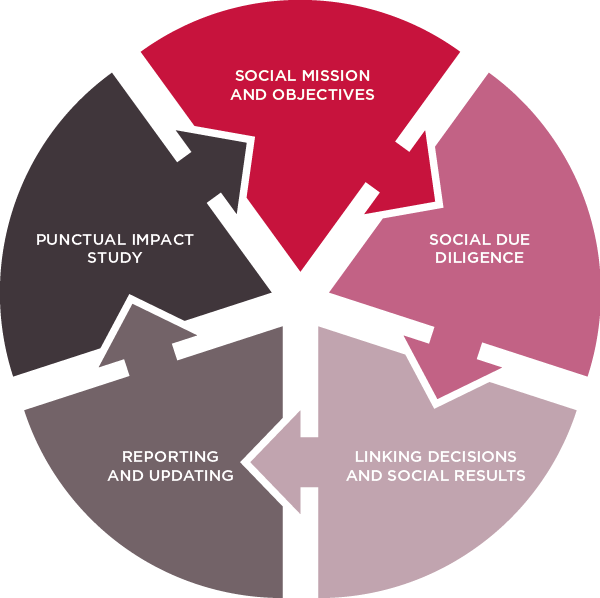

Inpulse cares about “triple bottom line” investments. The methodology we use to monitor and measure social and environmental performances of our funds is aligned with the best practices of the microfinance sector, namely the Universal Standards of the Social Performance Task Force (SPTF) and the IRIS guidelines set up by the Global Investing Network (GIIN). Our methodology is structured around 4 key steps:

- Selection of investees based on assessing their real commitments to achieve positive social outcomes. During due diligence, a set of indicators and questions is applied to assess the measure social performances in 4 selected areas.

- Definition of target objectives to be achieved by investees (“fléchage”, in french). These objectives are set up in accordance with the investees (and reflected in the loan agreement).

- Monitoring and reporting through a genuine social performance tool (the Social Performance Assessment – SPA – matrix) based on 4 main categories (Social mission, Products & services, Outreach and Staff treatment) that cover the whole spectrum of SPM, from analysis of the institution’s declared objectives to the efficiency of their systems. It also evaluates their products and services and whether they are likely to positively influence the life of their clients and employees.

- Implementation of punctual impact studies to detect social changes in the life of CoopMed final beneficiaries. This means to collect/analyze data (mostly related to households living conditions) from final targeted customers (ex. cooperators, refugees), including a more objective window into their experiences of a given product, and helps investees in use this data to improve their services ever enhancing overall levels of social performance.